We can now say it: 2023 was a great year for investors, with all major asset classes delivering strong returns:

Cash - 90-day T-bill; U.S. Aggregate Bonds - Bloomberg US Aggregate Bond Index; Real Estate - FTSE EPRA Nareit Developed REIT Index; Emerging Markets - MSCI Emerging Markets; High Yield Bonds - Bloomberg High Yield Bond Index; U.S. Small Cap - Russell 2000; International Equities - MSCI World ex USA; U.S. Large Cap - S&P 500

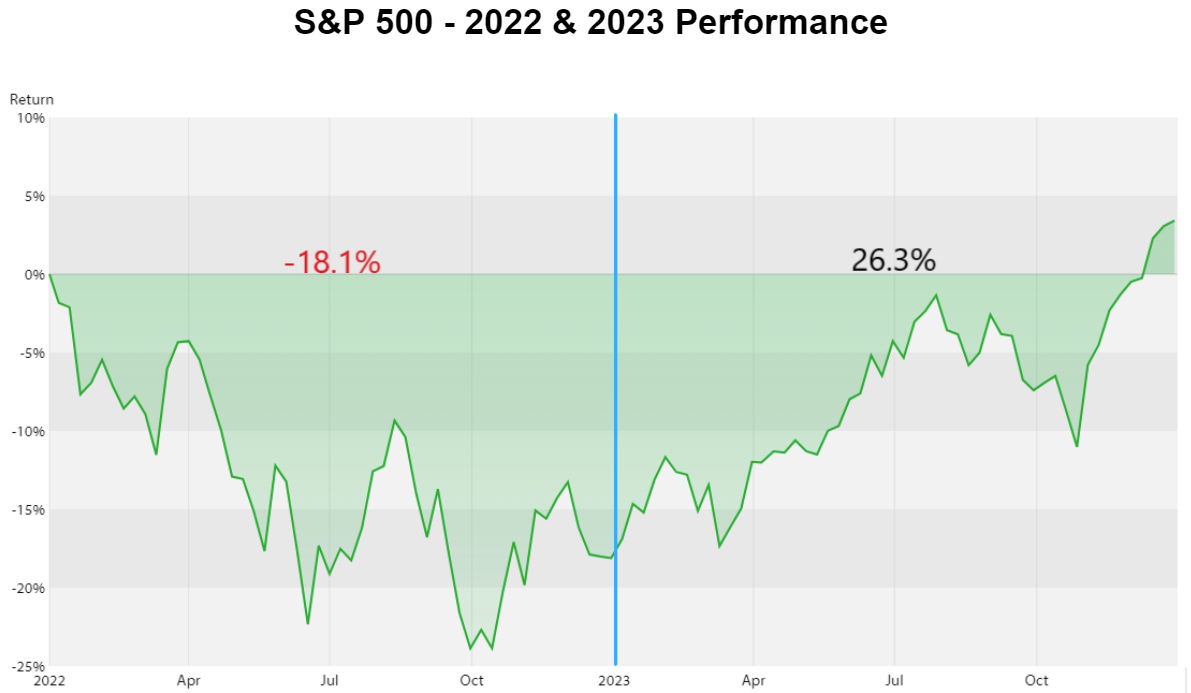

Naturally, it wasn’t a straight shot through the end of the year to receive these returns. The S&P 500 Index, in particular, took a volatile path and suffered through two steep declines – a 7% decline in the spring and a 10% decline in late summer and fall. You can see the Index’s trajectory in the chart below:

As the chart shows, it was the final nine weeks that transformed a good investment year to an excellent one. It took ten months for the Index to grind out a respectable 8.7% return. Then suddenly it basically doubled that amount in two months to finish at 26.3%, including dividends.

This type of steep acceleration is common in the equity markets, which is why we say that stocks earn most of their returns in short bursts. Market volatility is unsettling, though. Last year’s up’s and down’s combined with recent rate hikes by the Federal Reserve made the safety of cash look particularly attractive. One of the most common questions we received during the year was, “Why not just lock in 5% on a CD or money market fund and skip stocks altogether?”

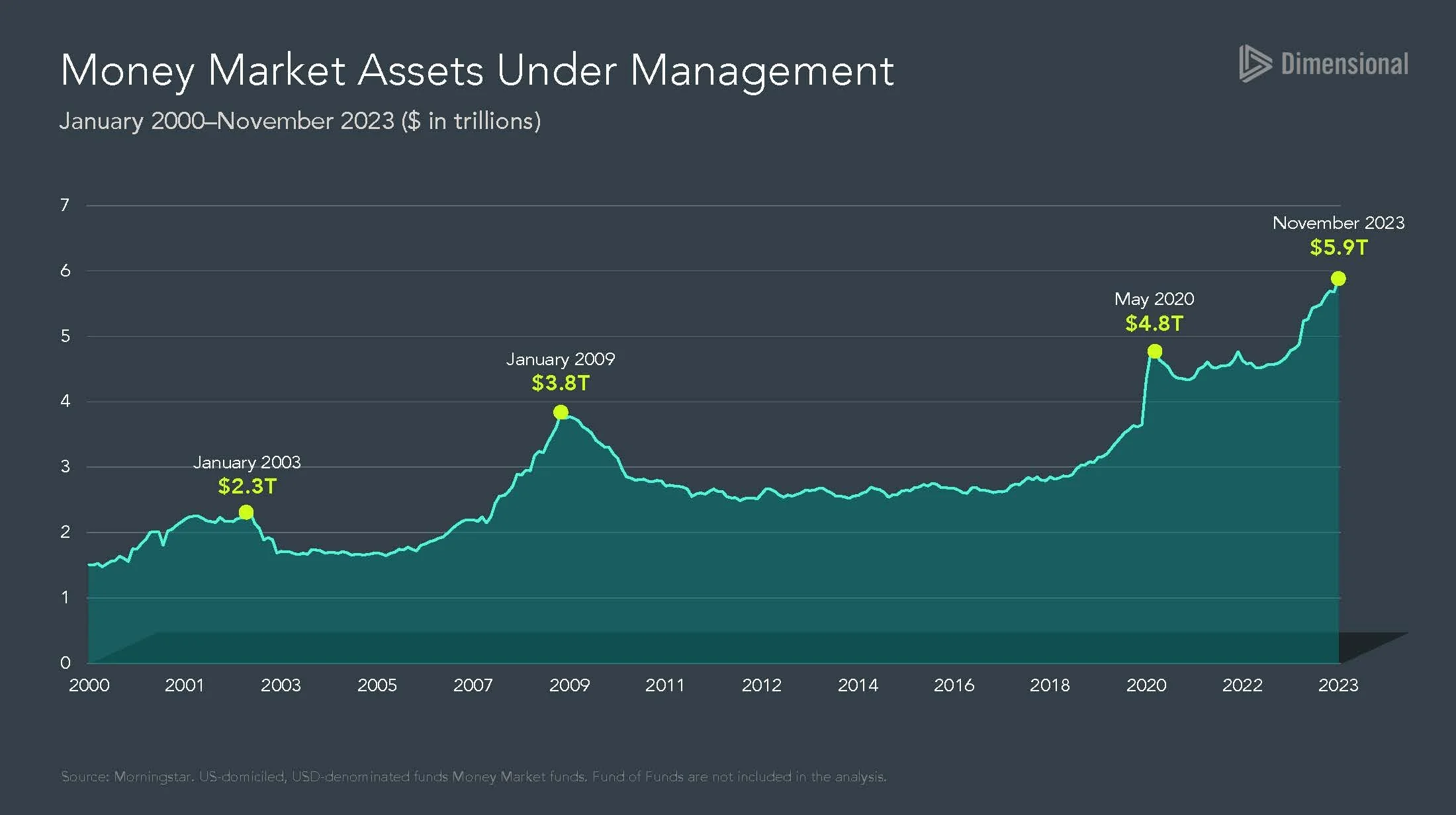

As it turns out, a lot of investors opted for just that, pouring a tremendous amount of money into money-market funds instead of stocks last year:

Depending on investors’ circumstances, this wasn’t necessarily a terrible move. However, as the chart at the top of this article shows, cash wound up being the lowest-performing asset class in 2023, trailing both bonds and stocks.

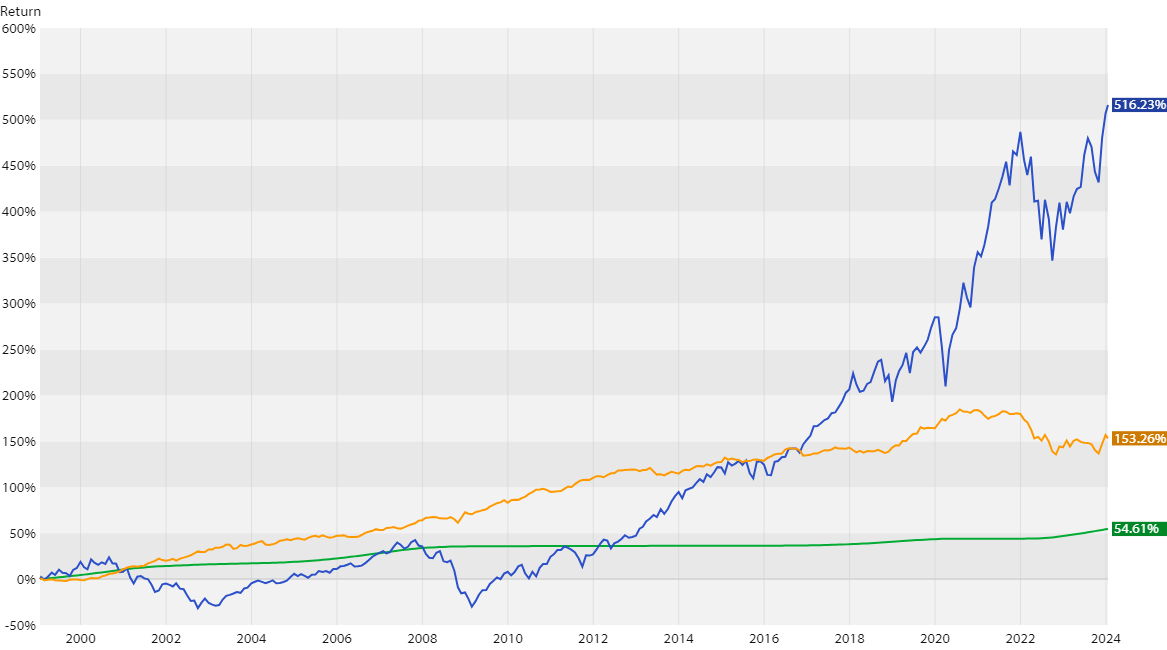

This is the typical relationship among the major asset classes, which exist along a continuum of risk and return. Historically, cash returns have tended to perform close to the rate of nominal inflation, trailing both stock and bond returns by a wide amount:

Blue - S&P 500; Orange - Barclays US Aggregate Bond Index, Green - Cash

As a result, what seems safe in the short term carries its own set of risks over the long term – a common story with investing.

Last year’s strong stock returns were a welcome turn of events. However, the gains of 2023 essentially won back the losses of 2022 to put stocks slightly ahead of where they were before the Federal Reserve’s rate increases:

A lot of what we think in terms of “good” or “bad” investments has to do with our frame of reference, and widening the lens can provide a more helpful perspective.

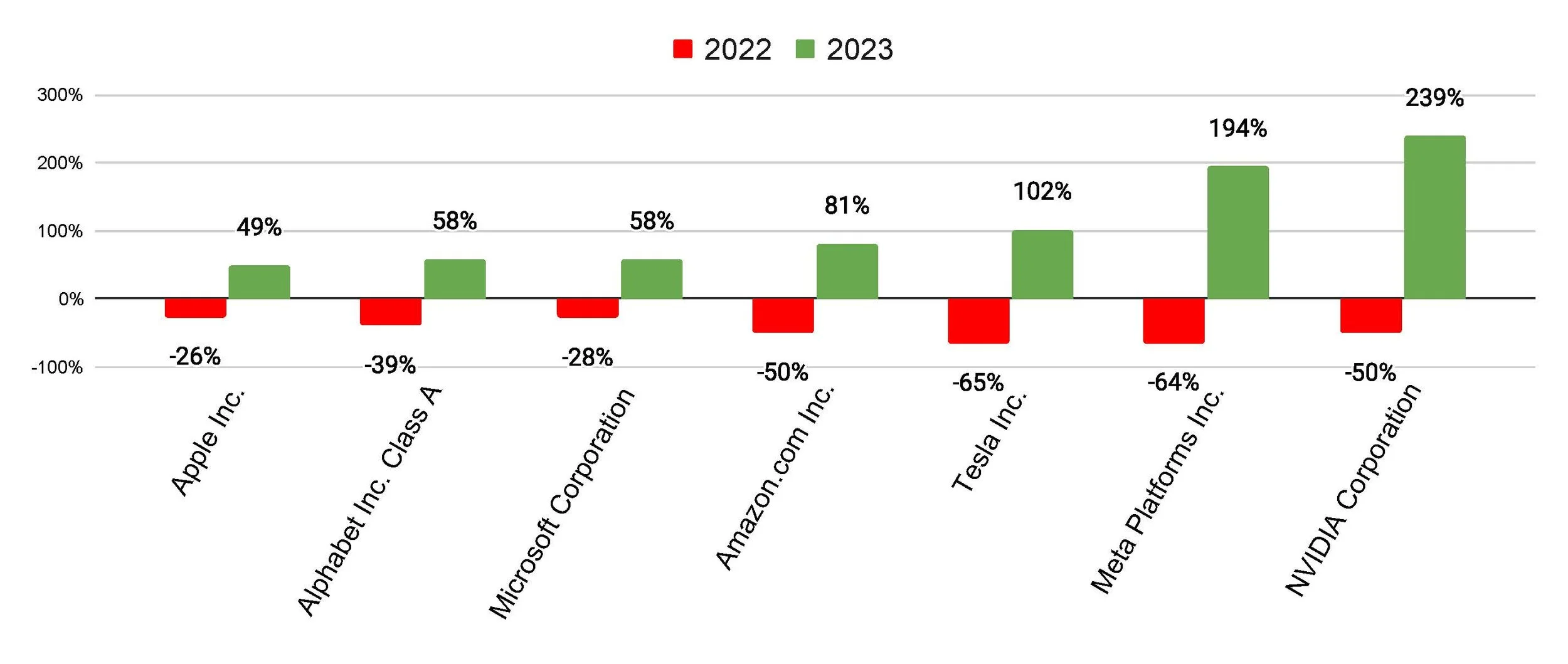

Similarly, it pays to ask not just what an investment returned, but how it earned that return, in order to assess its risks. Last year, a large portion of the S&P 500 Index’s return was delivered by a handful of large technology companies, dubbed “The Magnificent Seven”: Alphabet (Google), Amazon, Apple, Meta (Facebook), Microsoft, Nvidia and Tesla.

These companies, worth a combined $12 trillion, made up a staggering 28% of the Index’s value by the end of last year. Thus, while the Index is composed of approximately 500 companies, it’s essentially a concentrated bet on large tech companies, which themselves experienced large price swings between 2022 and 2023:

This type of stock concentration increases the underlying risk of the index. Investors ignore the extra risk when times are good, then tend to overreact and abandon investments when the risk shows up and prices decline, which is a recipe for disappointment.

The question is, What risks do we face going forward? Most of the usual suspects: uncertainty about geopolitical events, questions about what the Fed will do next with interest rates, and a host of economic questions about commercial real estate, employment, and consumer spending, among others.

The best way to navigate this uncertainty continues to be managing one’s exposure to risk by diversifying investments. Avoiding inadvertent risk within portfolios is one of our chief aims with the use of global diversification and portfolio rebalancing – a concept we’ve addressed before in Is Your Portfolio a Container Ship or Speed Boat? When your investment horizon is measured in decades, not just months or years, you probably want the bigger boat.