When the industrialist Andrew Carnegie was giving away his fortune last century to help establish the modern public library system in the United States, the critics were quick to pounce. They questioned his motives for giving and derided the amounts as too small, given his enormous wealth. As it turns out, the critics were onto something: articulating one’s purpose for charitable giving and financial capacity to do so are an excellent starting place for anyone determining how much they want to donate.

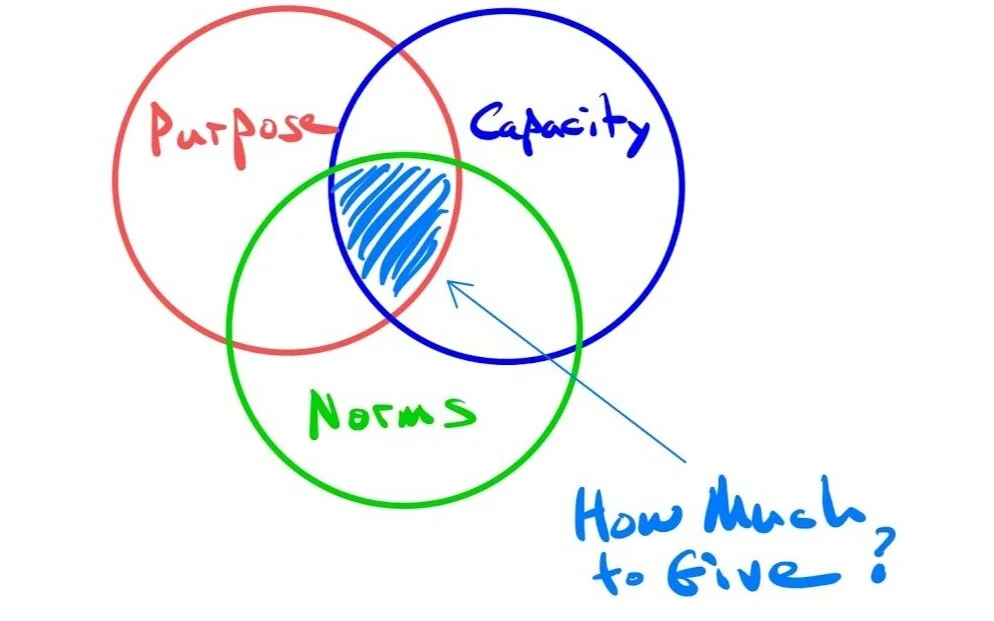

In a previous article, we discussed recent research showing that across all income levels, most people typically donate 1 to 2% of their annual income to charitable organizations, with a tendency to donate right in the middle at 1.5%. To figure out what’s appropriate for you, however, you should consider two other elements - your purpose for giving and your financial capacity for doing so.

Your Charitable Purpose

So why, exactly, are you choosing to donate money now? Answering this question can help determine your priorities and, in turn, the appropriate amounts.

You can, of course, choose simply to donate to a “good cause” and leave it at that, but remaining vague often comes with a cost. I once paid an unmentionable amount for a carrot cake under this rationale at a charity auction.

To give away money is an easy matter and in any man's power. But to decide to whom to give it and how large and when, and for what purpose and how, is neither in every man's power nor an easy matter.

–Aristotle

If nothing else, taking a moment to reflect on why you want to donate your money can help protect against undue influence. It’s no accident that fundraisers use social engineering like charity auctions, poker nights, and lotteries to raise money. The nonprofit sector invests in R&D to figure out ways to persuade people to hand over their money, and fundraising tactics are such a concern that state attorney generals sometimes weigh in to warn charities about unethical behavior.

You might consider the evidence that “being generous really does make you happier” and even good for your health:

Studies have shown that older people who are generous tend to have better health . . . other research has indicated that spending money on others can be as effective at lowering blood pressure as medication or exercise. “Moreover, there is a positive association between helping others and life expectancy,” . . . “perhaps because helping others reduces stress.”

This makes sense. Having something left over to give to others constitutes tangible proof that we have enough for ourselves, alleviating the feelings of scarcity that are hardwired into many of us.

Perhaps we want to “pay it forward” by supporting organizations that assisted us in some way, such as the local milk bank that helped our family years ago or an organization that makes our city more livable by planting trees on every block.

Another purpose might be to fulfill what Australian philosopher Peter Singer calls our moral duty to help others or simply to achieve a more self-interested goal of making sure the places we live are safe for ourselves.

Your Financial Capacity For Giving

Having determined your charitable purpose, it’s time to look at your pocketbook. Charitable giving is best done as a collaboration between your head and heart, so ideally, you’ll confirm that you have the financial capacity to give away money before committing to specific amounts.

It may seem ungenerous to consider charitable giving as a purchase decision. However, it’s a cash outflow that sits on the personal income statement alongside other financial commitments such as rent and mortgage payments, groceries, and savings goals for future needs.

Developing a cash flow statement to tally income and expenses is the best way to see how your charitable donations fit with other financial decisions. As we’ve written about before, “a cash-flow examination is a thoughtful reflection on how we’re spending our lives, not just our money.” As such, a cash flow statement is an excellent tool to evaluate the competing demands for your money.

A large part of altruism...is grounded upon the fact that it is uncomfortable to have unhappy people about one.

–H. L. Mencken

In our experience, most people can reduce their overall spending by ten percent without feeling much effect. If you need to reduce spending in other areas to make room for charitable donations, it’s probably feasible.

You’ll be doing yourself a favor, moreover, since if you can make room for donations, it means you’re not living too close to the bone. Your charitable giving will create a “margin of safety” in your finances, with enough money in “fat” years to help others and insurance for lean years when you may need extra money yourself.

This financial security, in turn, represents tangible evidence that you have “enough” and can create a sense of abundance in your life, proving one of the major tenets of many religions - that it really is better to give than to receive.

Tailoring Your Charitable Target -- With A Haiku to Help

Having looked at your charitable purpose and budget, you’re in position to make some decisions. But you still might wonder how much you ought to give? For this, we look to social norms - i.e., what’s everybody else doing -- to guide our thinking.

A man there was, though some did count him mad, the more he cast away, the more he had.

–John Bunyan

As noted, most people across all income levels donate between 1 to 2% of their annual income to charity, with a tendency to donate 1.5%. We could simply use this amount, making sure it fits in our budget, but since our financial circumstances tend to ebb and flow, we would benefit from a more flexible, pragmatic approach.

Use A Sliding Scale

Personal income and expenses often vary from year to year, so rather than force yourself to use a fixed 1.5% target for donations, consider targeting a range of 1 to 2% of annual income.

In strong financial years, you can give a little more, in lean years a little less, knowing that through thick and thin you’re meeting your charitable goals.

Consider Tithing From Windfalls

If you’re inclined to make charitable contributions and feel like you want to do more, windfalls from inheritances, stock options, and surprise bonuses provide an opportunity to apply the ancient practice of tithing, or donating 10% of your income to charity.

You’ll want to make sure you have enough income for your own needs, but if you do, grabbing 10% of the windfall and applying it directly to charity is a great way to increase your contributions. If your income is highly variable, taking advantage of windfalls is also a good way to front-load donations in good years, knowing you’ll likely need to reduce them in other years.

Donate Time When Money’s Not Available

If it’s simply not possible to cover all your expenses with the income on hand, you can donate your time instead. The National Center for Charitable Statistics has even put a value on the time spent volunteering by individuals, calculating that in 2017 it amounted to nearly 13% of the nearly half a trillion dollars given in private charity.

To sum it all up -- and with apologies to Michael Pollan, who inspired this idea -- here is a simple haiku to guide your annual charitable-giving assessment:

One to two percent.

Consider tithing windfalls.

Don’t forget your time.

If you need further inspiration for your good intentions, there are many examples to which we might look, but none better than MacKenzie Scott and her reasons for signing the Giving Pledge:

I found it this morning on a shelf of my books from college, toward the end of Annie Dillard’s The Writing Life. It was underlined and starred like all of the words that have inspired me most over the years, words that felt true in context, and also true in life: “Do not hoard what seems good for a later place in the book, or for another book… The impulse to save something good for a better place later is the signal to spend it now. Something more will arise for later, something better… Anything you do not give freely and abundantly becomes lost to you. You open your safe and find ashes.”

My approach to philanthropy will continue to be thoughtful. It will take time and effort and care. But I won’t wait. And I will keep at it until the safe is empty.